How to Promote financial Literacy Among children in Rwanda.

Empowering Children Through Financial Education and Banking in Rwanda.

June 15, 2023How to Promote financial Literacy Among children in Rwanda.

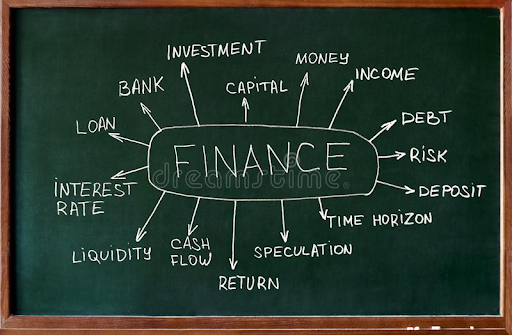

A person’s ability to make wise financial decisions depends on their level of financial literacy, which is their understanding and comprehension of financial concepts, instruments, and principles. It involves possessing the abilities necessary to handle money, create an efficient budget, save and invest wisely, and navigate different financial goods and services. In this article we shall explore ways on how to promote financial literacy among children in Rwanda.

According to Rwanda National Financial Education strategy, there are three main components of financial capabilities, Day-to-day cash flow management, which include: Making ends meet for both routine and large expenses. Keeping track of finances and budgeting, Understanding the difference between necessary and unnecessary expenses, and Avoiding unnecessary expenses. Planning for the future, which includes: Making contingencies, such as saving up or buying insurance, for future emergencies.

The financial literacy of parents is closely linked to the financial literacy of their children. Parents are children’s primary role models, and their spending patterns and outlook on money have a big impact on how they behave financially. Parents can establish similar habits in their children by modeling appropriate financial behaviors such as budgeting, saving, and investing wisely.

Additionally, parents play a big role in laying a strong foundation for financial literacy by presenting fundamental financial ideas to their children at a young age. Children’s financial awareness depends on open dialogue about money issues, including discussions about financial decisions and answering their inquiries. This indicates that financial awareness starts from parents to children to develop good financial habits and behaviors.

Current status of financial literacy in Rwanda :

Source:https://www.griegfoundation.com/our-stories/griegfoundatioscholars-5c779-lggpt

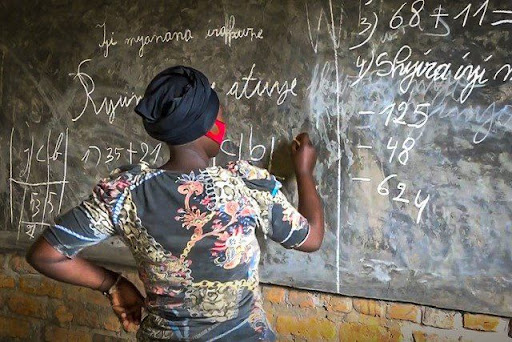

The Ministry of Finance and Economic Planning in Rwanda oversees the implementation of the National Financial Education Strategy to promote financial literacy. While progress has been made in implementing this strategy, there is a need for further strengthening of financial education in the country due to the persistently low levels of financial literacy among both males and females while this affects the financial literacy of children.

For instance, According to Rwanda National Financial Education Strategy the report reveals that less than half of the population in Rwanda possesses the ability to provide accurate responses to all four numeracy questions, which assess basic arithmetic operations such as addition, subtraction, multiplication, and division but there is disparity between Rwandans’ understanding and awareness of money management principles and their practical implementation.

The government has also been trying to improve children’s financial literacy where the Ministry of Education has implemented financial literacy programs in schools to equip children with essential financial knowledge and skills. These programs aim to teach children about money management, budgeting, saving, and responsible economic behavior.

Role of Non-profit Organizations and Financial Institutions :

Source:https:https://www.globalmoneyweek.org/

Furthermore, non-profit organizations and financial institutions have also played a role in promoting financial literacy among children in Rwanda. These organizations often collaborate with schools and educators to provide financial literacy workshops, resources, and educational materials targeted specifically at children.

These initiatives aim to improve children’s understanding of money and finances in an engaging and age-appropriate manner. During Global Money week , financial literacy awareness sessions were offered to children, youth, and adults, mostly through a hybrid format.

This included sessions about the importance of early saving, stock market operation, high-level virtual discussions about various themes, and other educational sessions.

In 2022, AIESEC in Rwanda focused on reaching both children and youth through in-person visits that took place in different primary schools in Kigali and Huye. Students were educated about money matters and how they can prepare for the future through savings starting at an early age.

The importance of educating parents about money management is shown by the fact that parental financial literacy has a considerable impact on the financial literacy of their children.

By equipping children with essential financial knowledge and skills, they can develop responsible money habits, make informed financial decisions, and navigate the economic landscape confidently. Empowering the future generation with financial literacy will contribute to their financial independence, resilience, and overall economic growth.