Empowering Children Through Financial Education and Banking in Rwanda.

Navigating the Online Financial World Safely For Kids.

June 15, 2023

How to Promote financial Literacy Among children in Rwanda.

June 15, 2023Empowering Children Through Financial Education and Banking in Rwanda.

As mentioned by Rwanda Development Board , the banking industry in Rwanda has made considerable strides in recent years, playing a critical role in driving the nation’s overall growth and development. In this article titled empowering children through financial education and banking Rwanda, we shall look at how Rwanda’s banking sector does not only focus on driving economic growth and financial inclusion but also recognizes the importance of empowering children with financial knowledge and skills.

The banking sector in Rwanda has transformed into a driver for economic growth, while empowering people and businesses all around the country, with a strong focus on financial inclusion and technological innovation.

By developing a culture of financial literacy from a young age, Rwanda aims to equip its future generations with the tools to make informed financial decisions, promote responsible saving habits, and foster a sense of economic empowerment. The integration of children into the banking system contributes to building a strong foundation for sustainable economic development and inclusive prosperity.

Financial Education in Schools :

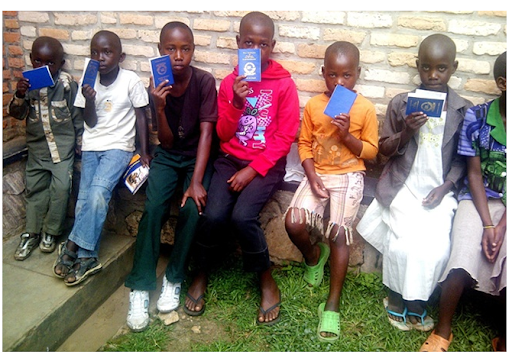

source : https://www.ktpress.rw/2015/11/rwandan-kids-raise-rwf400m-in-bank-savings/

Rwanda has made an effort to include financial education in the academic program. In order to provide age-appropriate financial literacy programs, the government has worked with banks and financial organizations. This is because it has come to notice that kids are open to learning about money management, saving, budgeting, and investing.

These programs seek to provide students with practical knowledge, such as an appreciation of the value of money, the significance of saving, and fundamental banking principles. Rwanda is producing a generation of financially smart people who are well-prepared for their futures by incorporating financial education into schools

Additionally, In partnership with banks, Rwanda has implemented school banking programs that bring banking services directly to students. These programs allow children to deposit and withdraw money within the school premises, promoting financial independence and accessibility.

School banking programs create opportunities for hands-on learning about banking transactions, fostering practical skills and confidence in managing personal finances. Through these programs, children gain early exposure to the banking system, demystifying financial institutions and building trust in financial services.

The Role of Banks in Empowering Children :

Source:https://www.gtbank.co.rw/personal-banking/accounts/savings-investment-accounts/smart-kids-save-sks-1

To encourage a savings culture among children, Rwandan banks offer specialized youth savings accounts. These accounts are designed to instill a sense of financial responsibility and enable children to experience the benefits of saving early on.

With parental consent, children can open accounts, deposit money, and track their savings progress. Youth savings accounts often come with additional features like educational incentives, such as scholarships or prizes, encouraging children to develop positive financial habits and long-term planning skills.

For instance, Guaranty trust bank has introduced ( Smart kids save account) where parents/guardians save for their children under 18 years of age, whilst also developing a savings culture for them.

Bank of kigali has also designed a Kira kibondo account where parents can secure the future of their kids aged between 0 to 16.

The Benefits of Empowering Children Through Financial Education and Banking :

Source: https://blog.usalliance.org/financial-literacy-for-kids

Empowering children through financial education and banking has numerous benefits.

First, it provides them with the knowledge and skills needed to manage personal finances effectively, a crucial aspect of living self-sufficiently. Financial education teaches children about topics such as saving, budgeting, and investing, helping them to make informed financial decisions and avoid debt in the future.

Additionally, Banking enables children to access and utilize formal financial services, such as saving accounts and loans. This not only reinforces financial literacy but also promotes financial inclusion, providing children with a means to participate in the economy and improve their livelihoods.

Furthermore, a financially literate and empowered younger generation will strengthen the economy in the long run by fostering entrepreneurship and investment.

In Rwanda, banking goes beyond financial transactions and profit-making; it extends to nurturing financial literacy among children. By integrating financial education into schools, offering specialized youth savings accounts, implementing school banking programs, leveraging technology, Rwanda is investing in its future by equipping children with the skills and knowledge necessary to navigate the complexities of the financial world.